Understanding Probate

When someone dies, their heirs do not immediately get their inheritance. Instead, the estate usually has to go through probate. Probate is a process that lets the executor/administrator of the estate wind up the deceased person’s affairs. That includes paying any bills the deceased owed, collecting any debts to the deceased, and converting estate property into a format that matches the deceased’s bequests. How long that takes depends on the complexity of the estate. Probate for a simple estate can take six months. For more complex estates with conflict, it can take years.

So, what happens if you need access to some of your inheritance before probate ends? Then, you may want to get a probate advance. With a probate advance, we purchase a portion of your inheritance. Then, when probate concludes, we collect the from the estate, not from you. It is a great way to help people who need cash before probate concludes. However, how do you determine if a probate advance is right for you?

The Probate Process

The probate process varies from state to state and estate to estate. However, the basics are the same. The executor, administrator, or personal representative needs to inventory the estate’s assets, collect any debts due to the estate, and pay any of the estate’s debts. If there is some dispute, this process can take longer. Conflicts can happen when heirs or potential heirs contest the Will. However, Will disputes are not that common. Delays are more likely due to the administrator challenging a creditor’s claim, liquidating assets, or having to take legal action against an heir.

Depending on how the property is distributed, the administrator must liquidate the estate’s assets. That can take a long time. Things that can complicate that process include real estate holdings or if the deceased owned all or part of a business. Any unusual collections, stocks, and other personal property can also be difficult to liquidate. In addition, the administrator has to pay state and federal taxes. For a complicated estate, this process can take years instead of months.

Getting Money During Probate

What happens if you need money before the end of the probate process? Even if you were not financially dependent on the deceased, you may need access to some cash before probate ends. For example, if one family member wants to purchase the family home but does not have the money to buy out other heirs, they may need access to cash. If you were financially dependent on the deceased, you may need an advance for living expenses. An inheritance cash advance lets you get part of your inheritance before the probate is completed. It is not a loan. Instead, you essentially sell a share of your inheritance to us, and we collect our percentage when the probate is complete.

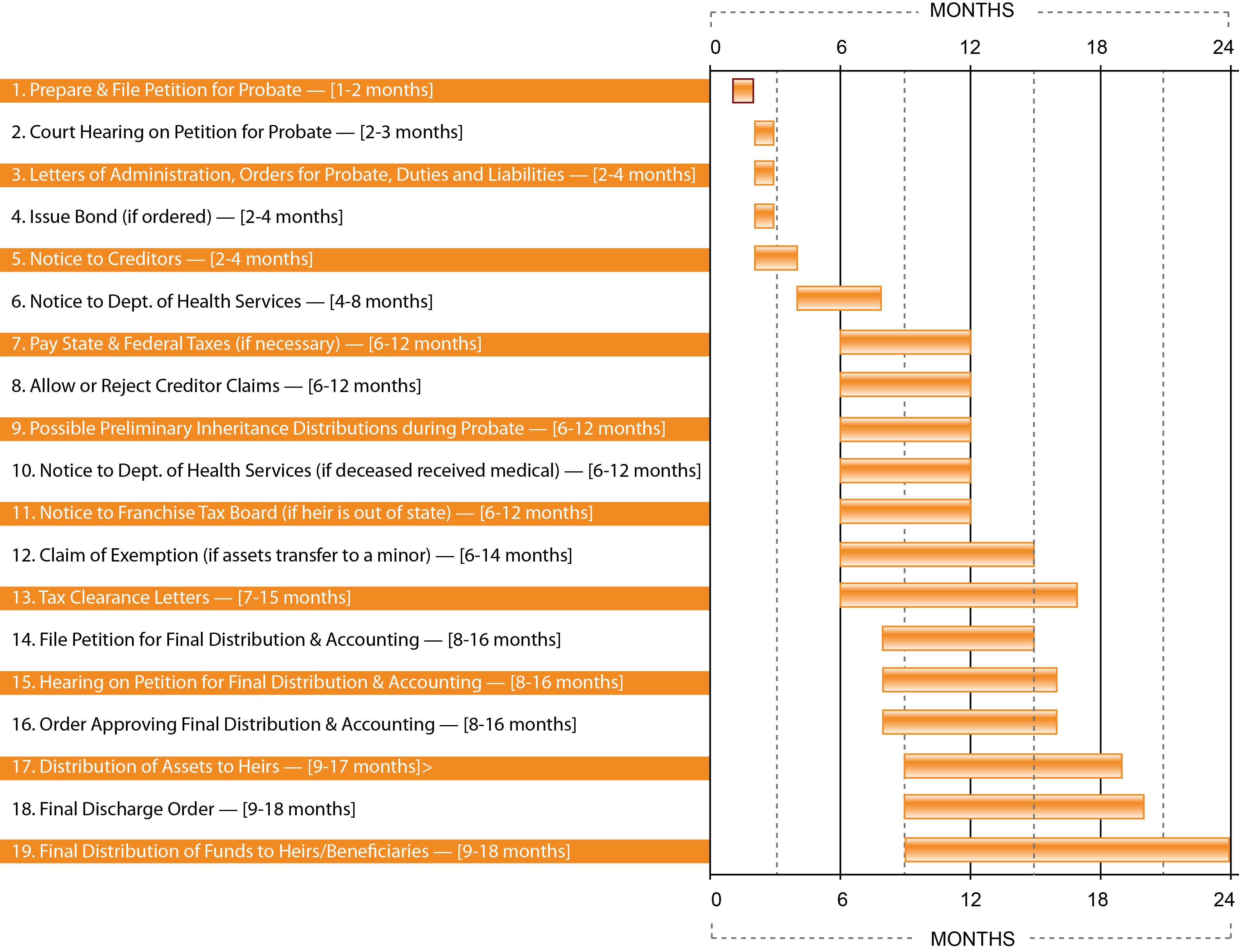

Probate Timeline

Thinking About Getting an Advance on Your Inheritance? See where you are in the process!

When a loved one passes, it can take months, or even years, to see the money that has been left in your name. At My Inheritance Cash, we know how difficult this time can be, and we believe it should be spent remembering your loved one, not fighting over funds that are rightfully yours.

We are determined to get you your cash FAST! Our fast inheritance cash advances and inheritance funding programs let beneficiaries borrow money against their estate inheritance for immediate personal use. Our probate advances have the fastest turnaround in the industry.

NO interest. NO stress!

The Difference Between Inheritance Advances and Inheritance Loans

While many people use the terms interchangeably, there is a difference between an inheritance advance and an inheritance loan. With an inheritance loan, you must demonstrate that you are creditworthy. You may have to provide collateral, pay interest, and make payments on the loan amount. Plus, you are responsible for the total amount of the loan, even if your inheritance is lower than anticipated. The inheritance advance lets you access a portion of your inheritance now. You pay a fee for the service. You have no further obligations to us because we get our portion directly from the estate. The process is quicker than an inheritance loan; we can fund many cash advances within 24 hours.

One of the best things about an inheritance advance is that it shifts risk away from you. We provide the funds. If something makes the estate lose its value, we take the loss. So, you can end up with funds, even if other heirs lose their inheritances.

Inheritance advances may also be better than using your credit. Because the probate process can take an indeterminate length of time, that can mean that you pay a lot of interest, that your credit score will drop, or even that you may struggle to make payments.

Can Someone Get an Advance of Their Whole Inheritance?

Generally, the answer to this is no. Inheritance funding companies generally will advance a maximum percentage of an anticipated inheritance. After all, we want to ensure we can collect our money at the end of the probate process. While we take the risk that the estate will not have sufficient funds to pay us, we do want to minimize that risk. So, whether you use us or another inheritance funding company, you can expect to be able to advance around 35% of the inheritance.

Can Executors Get Advances from the Estate?

One of the issues people may not consider is that probate can be expensive. Suppose an estate does not have plenty of cash assets. In that case, the executor may need to liquidate assets to pay for the probate process. So, you may wonder if executors can get advances from the estate to help pay for winding up the estate. The answer is YES!

Are There Inheritance Scammers?

Suppose an inheritance funding company offers to lend you an unusually high percentage of your inheritance. In that case, that is a potential red flag. While reputable companies like ours provide inheritance funding, there are also scammers. A reliable inheritance company will need you to provide documents that you are an heir. You must sign paperwork assigning a portion of your share to that company. The process is not complicated, but it does involve proof. Please check reviews before you choose a funding lender. The last thing you want is to be caught in an inheritance scam.

What Is the Fee for an Inheritance Advance?

The fee for your inheritance advance depends on the amount of your advance and the projected length of time for the probate to conclude. We calculate the fee individually for each person. However, we offer no-cost, no-obligation assessments. We can tell you the exact fee in advance so you can decide whether to move forward.

Our fast inheritance cash advance is YOUR money, on YOUR schedule. Use inheritance funding to:

Cover Urgent or Unexpected Expenses

Why wait when you can get a fast inheritance cash advance NOW? Unlike a loan, inheritance funding is YOUR money, meaning you can use it however you want. From legal fees to college tuition, our large inheritance cash advances will help keep you afloat during the probate process.

After the death of a loved one, you shouldn’t have to worry about food, shelter, and fundamental needs for survival. During this time, our estate inheritance funding ensures that you get the money you need, when you need it most. After all, it is YOUR money!

Unlike a loan, our cash advances are YOUR money. You’ll never have to pay interest, and you don’t have to pay anything back! Simply get in touch to get your money, FAST!

Attend to Estate Fees

After the death of a loved one, it can be a struggle to stay afloat. From maintaining the estate to paying legal fees, why not get a large inheritance cash advance to keep in the green? Our fast inheritance cash advances are YOUR money, meaning you’ll never have to pay interest! This is NOT a loan!

We have the fastest turnaround in the industry! Speak with one of our probate inheritance funding professionals today!

Consolidate or Settle Debt

Take care of outstanding debt with a lump sum of cash, FAST! Our large inheritance cash advances are YOUR money, meaning you’ll never have to pay it back!

When a loved one passes and an estate goes to probate, it could be years before you see your money. Instead, our fast inheritance cash advances give you the money you need, when you need it most! During this stressful time, many beneficiaries find our inheritance funding a life saver, using it to consolidate or settle debt that has nagged them for years.

An Inheritance Advance isn’t a loan, meaning you’ll never be responsible for recourse due to non-payment. Simply get your cash, negotiate a settlement with creditors, and say goodbye to debt! With our fast inheritance cash advances, it’s EASY!

Keep Your Family Safe

Tragedy can strike at any moment, and a large inheritance cash advance could be the difference between life and death. With our fast inheritance funding, your family won’t have to scrounge for funds in a disaster. Be safe, not sorry!

At My Inheritance Cash, our large inheritance cash advance is an advance on your inheritance. This is NOT a loan, so there’s NO interest! Rather than wait years for an estate to clear probate, our fast inheritance funding is YOUR money, when you need it most!

Benefits of Inheritance Advances

No matter how desperately you need it, banks are hesitant to lend money. Even if you do get approved, it could take years to pay off interest and fees. Instead, an inheritance cash advance is YOUR cash, NOW!

When an estate enters probate, it could be months, or even years, before you see your money. With a fast inheritance cash advance, you get the money you deserve on your schedule, not the court’s. Unlike a loan, there is NO interest, EVER!

If you’re tired of applying for personal loans to get by, inheritance funding may be just what you need. With the fastest turnaround in the industry, there’s NO credit check or lengthy application! Once approved, you’ll see the money in your account within 72 hours!

Frequently Asked Questions

With My Inheritance Cash, borrowing against your inheritance is easy! Our no-interest no-hassle program allows you to get the money you deserve, FAST! Rather than let your inheritance sit in probate for months or years, our stress-free inheritance funding is designed to put your inheritance where it belongs – in your pocket! Once approved, you could see your money in as few as 2 days!

Yes! Probate is the perfect time to take money out of your inheritance. In fact, this is the ideal time for our professional team to get on the case and expedite the process! Why wait years for an estate to go through probate when you could see your money in as little as 48 to 72 hours!

Probate is the process of managing and distributing an estate after a person has passed away. Estate here means everything that your loved one owned, which can be anything from fine jewelry and furniture to land and lump sums of cash. Regardless of whether there was a will, this process can quickly become long and drawn out, especially when beneficiaries dispute the allocation of assets and/or property.

Probate can take years, meaning there’s no knowing how long you’ll have to wait to see your inheritance money. With My Inheritance Cash, you’ll see your money in as little as 48 to 72 hours.

Your money is YOUR money! Unlike a loan, inheritance funding is an advance on your inheritance, meaning there is NO interest, and NO hassle! There’s no credit check and no lengthy application – all we need is proof that the money is yours! Once approved, you can expect to see funds in your account in as few as 2 to 3 days!

An inheritance cash advance is YOUR money! There are NO fees, NO interest, and NO stress! Unlike a loan, you’ll never have to pay us back. We’re just giving you what’s already yours!

If you’re looking for the best company to get an advance during probate, you’ve come to the right place! With over a decade of experience, the seasoned team of professionals at My Inheritance Cash is here to help you get the cash you deserve, FAST! With the fastest turnaround in the industry, you can rest assured that your money is in good hands …. YOURS!